buying a business with seller financing

Sellers are usually more willing than banks to offer financing to individuals who. A business is being sold for 1 million.

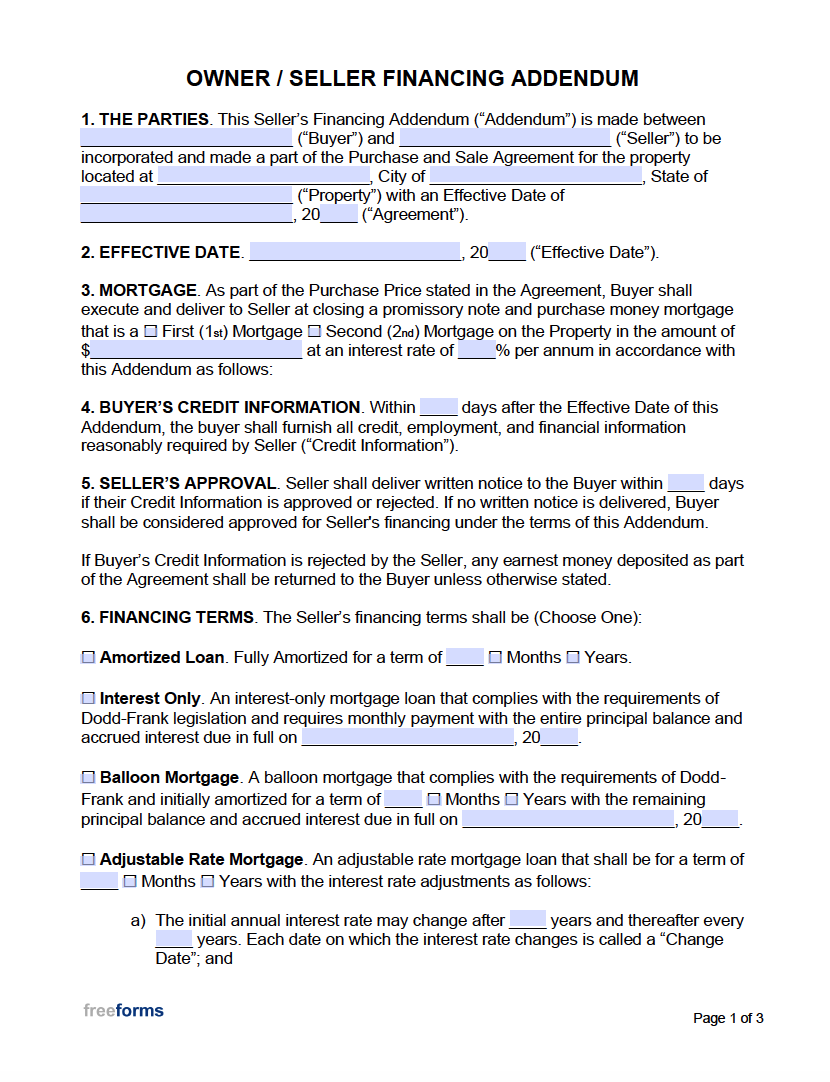

Owner Financing Contract Template Pdf Templates Jotform

Seller financing is when a businesss original owner offers the buyer a loan to cover a portion of the price of the business.

. Keep more profit while reducing risk and stress. Seller financing requires. Example of Seller Financing a Business Acquisition.

Here is an example of how this. So with the help of her business broker she negotiated a seller-financing deal and bought the. It means that the seller works out an arrangement where the buyer makes.

Start applying now dont wait. Buy a Seller Financed Business - A owner Financed business or seller financing is a loan provided by the seller of a business to the business buyer without a good credit who is finding it hard or. A portion of the business can be paid off over time with interest.

Craig can request that John provide some type of seller financing. Lets plan your success. Ad Compare 2022s Top Online Lenders.

First the buyer makes a down payment in cash as soon. Better access to financing. The new owner purchased an asset the existing business.

Learn more about Affirm for businesses and start driving more sales today. With few physical assets to borrow against she was unlikely to get a bank loan. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan.

Buying With Samsung Is Easy Get Credit Approval Start Shopping In As Little As 30 Sec. A promissory note signed by. Seller financing doesnt mean that the owner gives the buyer money to purchase their own business.

Ad Get Access to 1000s of grant apps. Basically the purchase price less any cash equals seller financing. The seller agrees to extend the buyer seller financing for 50 of the purchase price.

The Business Brokerage Press finds owner financing increases the average sale value by 1015. Scenario 1 All Seller Financing Here is a scenario that Craig can pursue. One option to solve this problem is called Seller Financing or Owner.

Below are some of the advantages buyers see with seller financing. Ad Buy now pay later solutions give your customers the power to buy what they need today. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan.

What Is Seller Financing for a Business. Often the person selling you their business will loan you money that you can pay back over time typically using the profits you make off the business. An asset purchase agreement which outlines the terms of the sale including the sale amount and any seller financing.

Lets plan your success. Keep more profit while reducing risk and stress. It is recorded that way.

Sellers financing for a business is when the. Common terms in a seller-financed note include an interest rate between 7. 2 Years in Business 200k Annual Revenue Recommended for Largest Selection.

Get a Business Loan Today. Ad Enjoy Instant Approval Net Terms No Fees That Expand With Your Evolving Business. OBE is only for existing.

In some cases the buyer of a business may not have all the capital required to pay the full purchase price. Its similar to a.

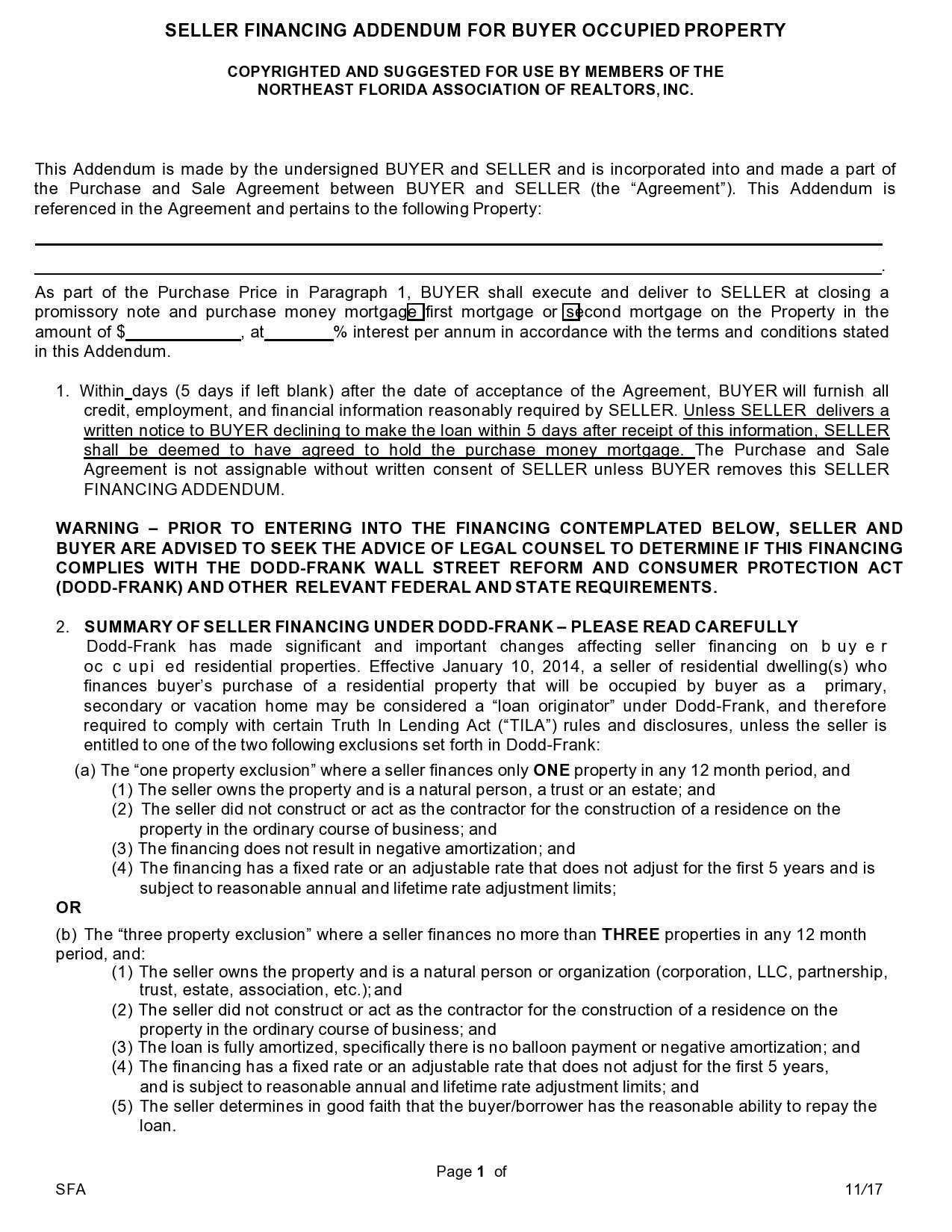

43 Seller Financing Addendum Samples Free ᐅ Templatelab

For Sale By Owner Seller Financing With Small Businesses Guidant

Seller Financing Addendum Trec

Free Owner Seller Financing Addendum Pdf Word

Free Third 3rd Party Financing Addendum For Conventional Fha Or Va Loans Pdf Word Eforms

100 Seller Financing No Money Down Businesses Youtube

Application For Sale By Owner Seller Financing Purchase Agreement Printable Blank Form Print Home Own Contract Template Real Estate Forms Room Rental Agreement

43 Seller Financing Addendum Samples Free ᐅ Templatelab

3 Reasons To Consider Seller Financing In The Sale Of Your Business Youtube

Belum ada Komentar untuk "buying a business with seller financing"

Posting Komentar